RTA Web - Asset Financial Tab

The financial tab holds multiple panels all designed to hold pertinent information pertaining to asset financials. This article will cover all the panels and fields found in the financial tab.

You can visit Asset File Table of Contents to access the full list of articles related to Displayed Vehicle Data in RTA Web here.

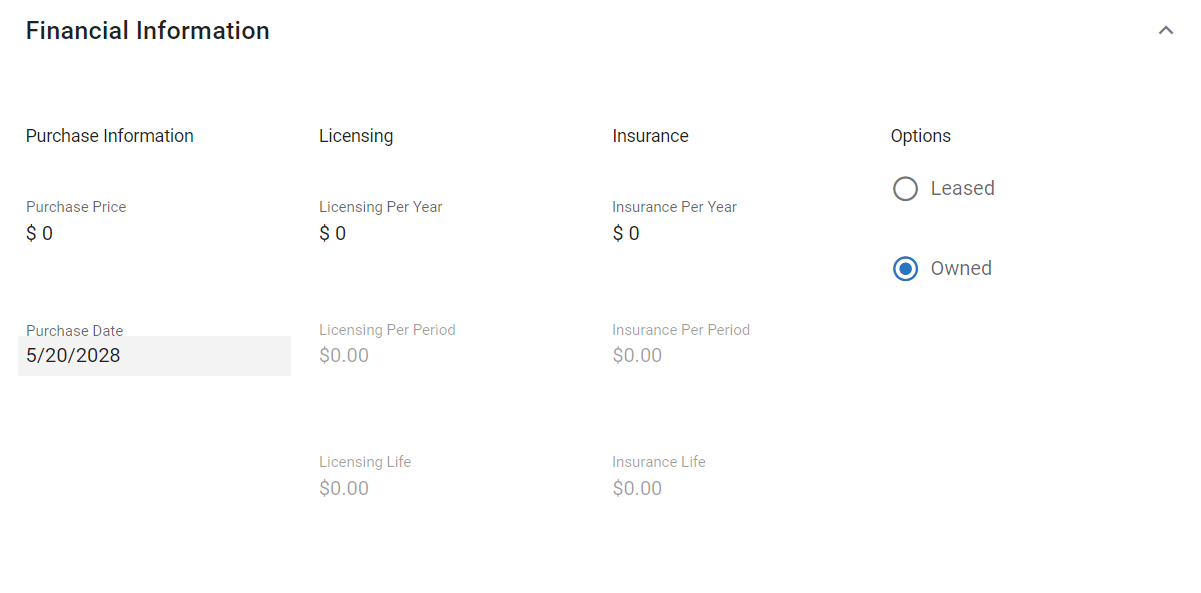

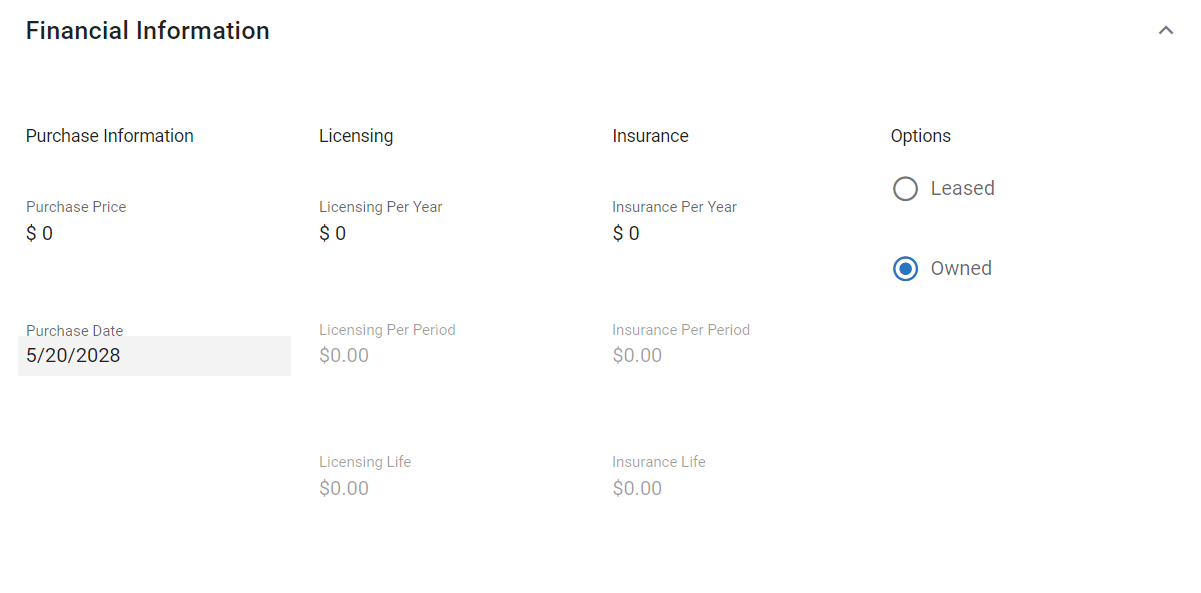

The financial information panel is segmented into 4 categories: Purchase Information, Licensing, Insurance, and options. See below for descriptions of each field in this panel.

Click here to expand...

Licensing

🔓 Licensing Per Year: Cost of asset licensing/registration on a yearly basis

Licensing Per Period: Auto-calculates the cost per month based on the annual cost entered

Licensing Life: Auto-calculates the total cost of licensing for the life of the asset

Insurance

🔓 Insurance Per Year: Cost of asset insurance on a yearly basis

Insurance Per Period: Auto-calculates the cost per month based on the annual cost entered

Insurance Life: Auto-calculates the cost per month based on the annual cost entered

Options

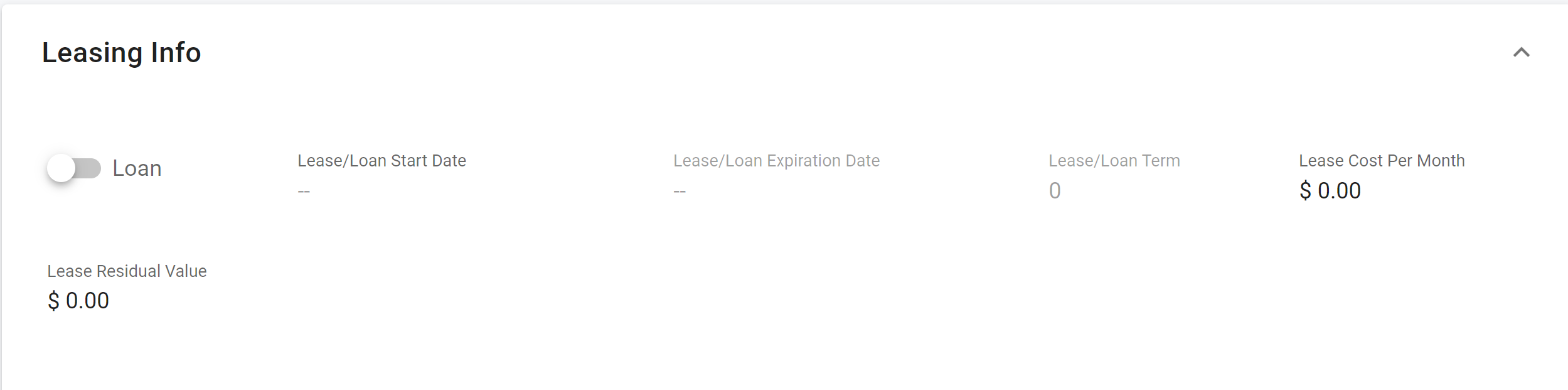

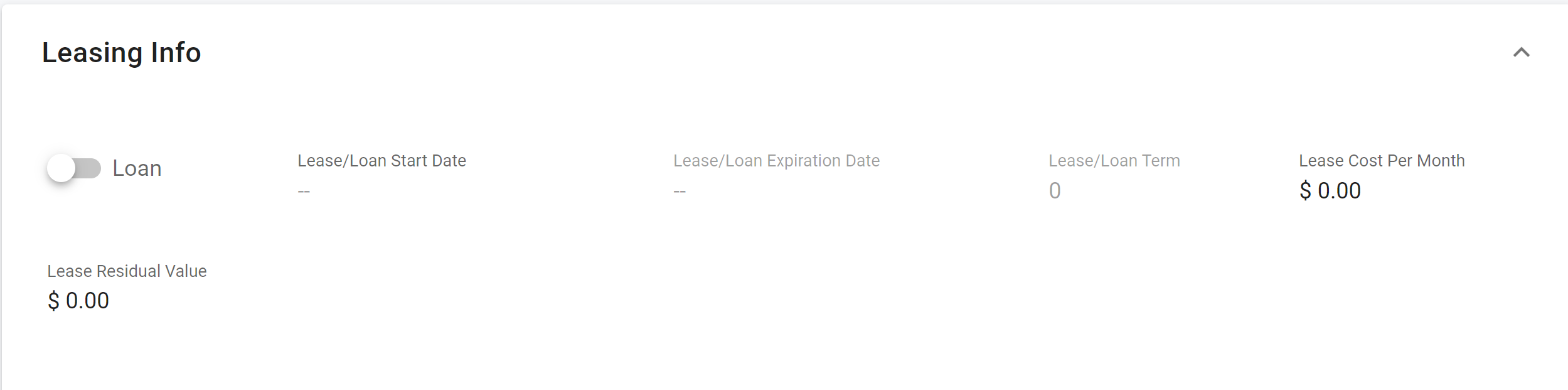

🔓 Leased: Select if the asset is leased

You will get a panel to input the lease information rather than asset depreciation. Lease cost will count toward asset fixed cost.

Add the Lease/ Loan Start Date

Add the Lease/ Loan Start Date

Add the Lease/ Loan Expiration Date

Add the Lease/ Loan Expiration Date

Lease/ Loan Term will Auto-Calculate

Add the Lease/ Loan Cost per Month

Add the Lease/ Loan Cost per Month

Add the Lease Residual Value

Add the Lease Residual Value

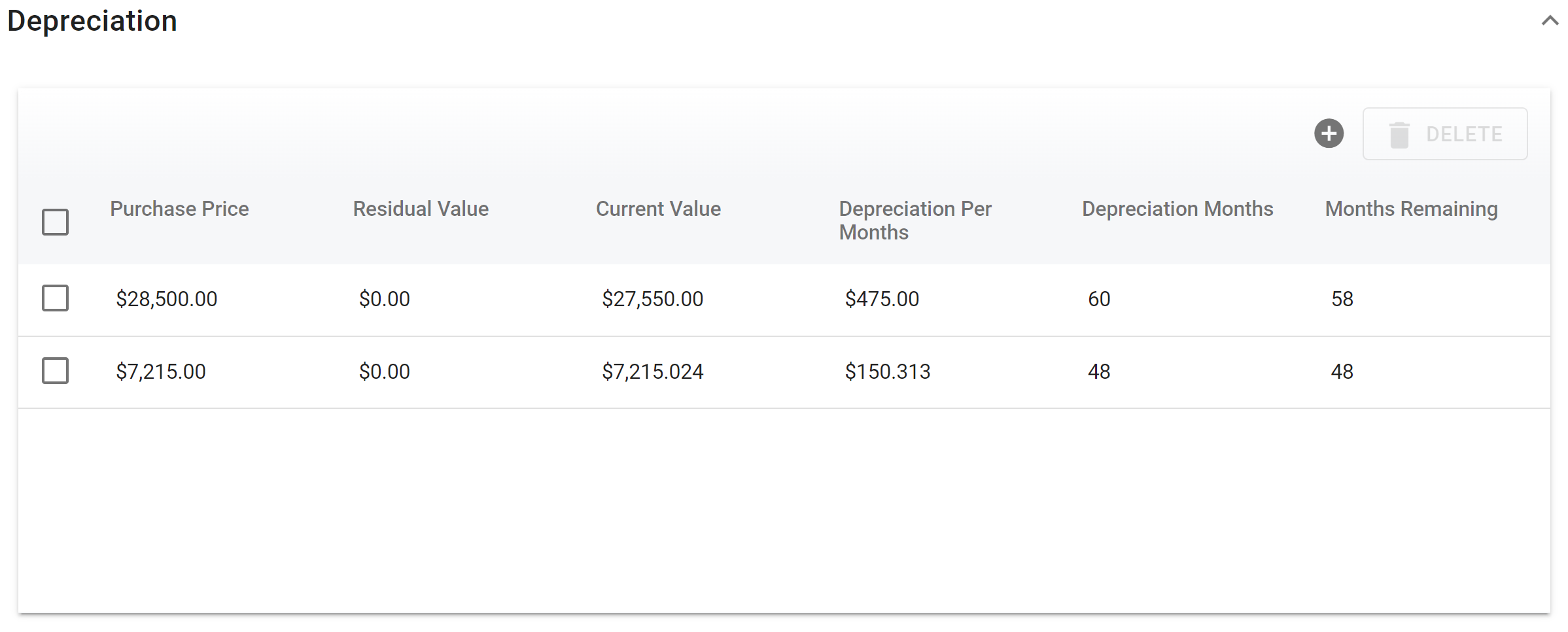

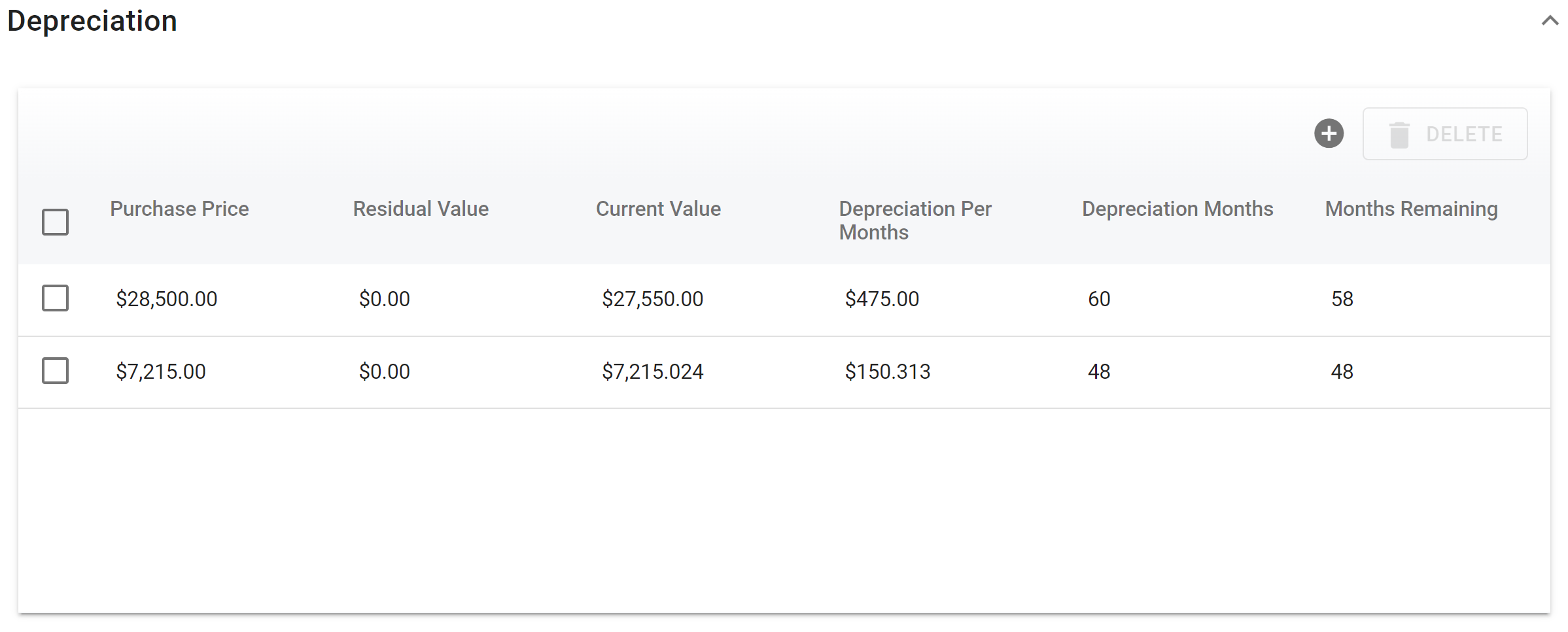

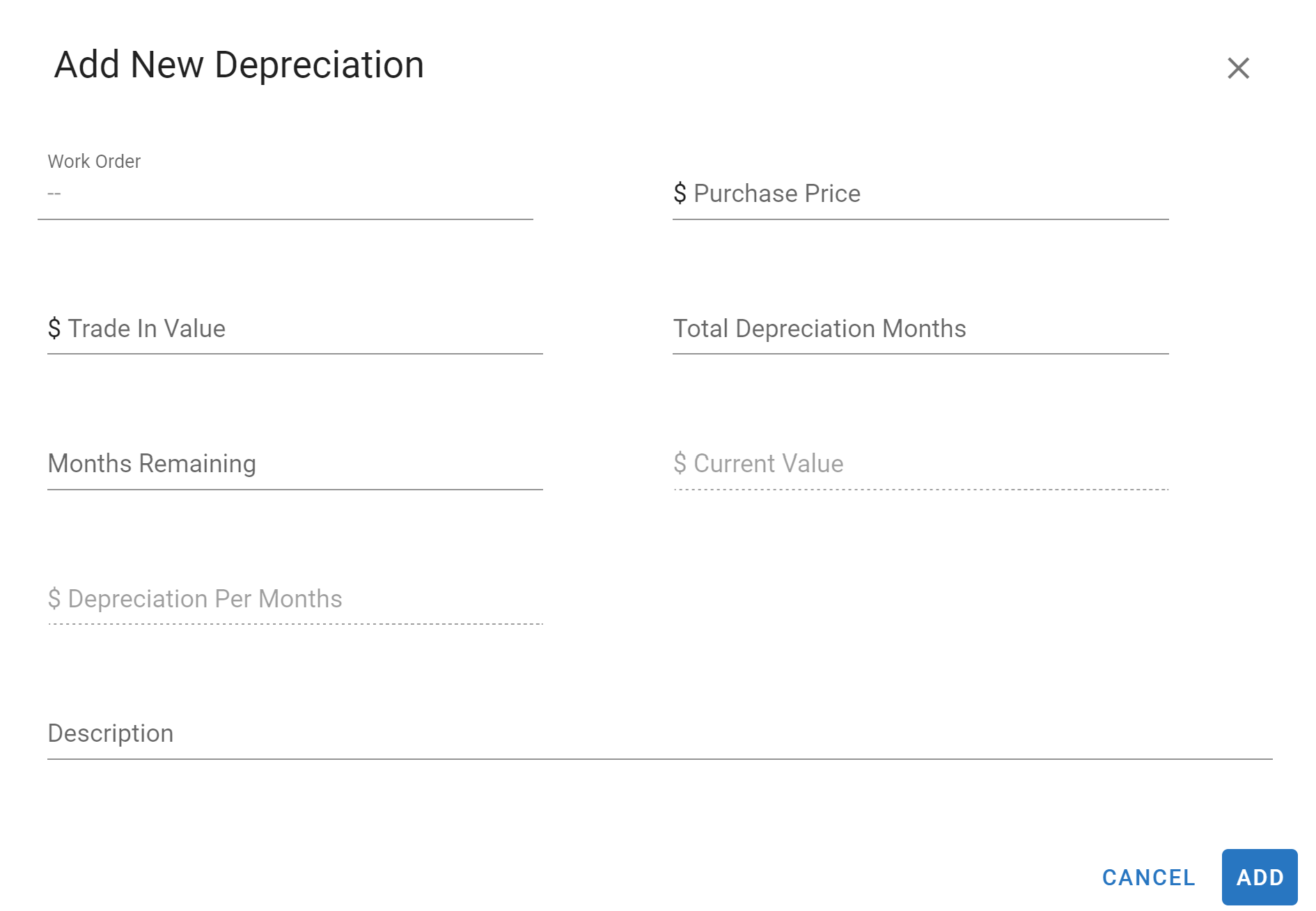

Depreciation Panel

You can add multiple depreciation lines as well as add Capitalized Work Orders to depreciation. Any depreciation added will count toward asset fixed costs.

See below for descriptions of each field in this panel.

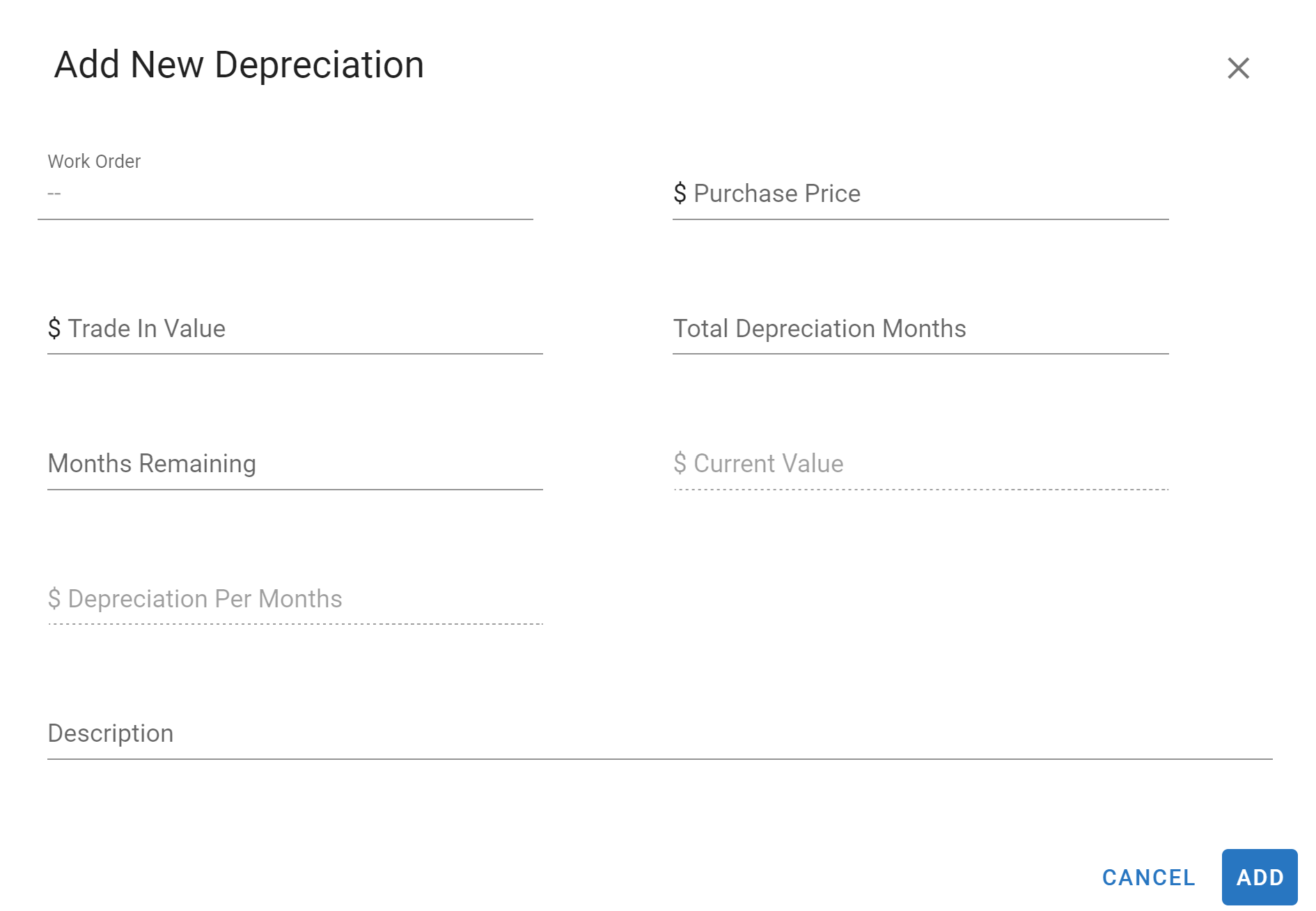

Work Order: Work order number you want to Capitalize and Depreciate

Work Order: Work order number you want to Capitalize and Depreciate

🔓 Purchase Price: Asset’s purchase price plus any upfit cost

🔓 Residual Value: Estimated trade-in value

Current Value: Auto-calculates based on depreciation data entered

Depreciation Per Month: Auto-calculates based on depreciation data entered

🔓 Depreciation Months: Total number of depreciation periods for the asset

🔓 Months Remaining: Total number of depreciation periods remaining for the asset

When entering depreciation for partially depreciated assets, the amount already depreciated does not post to the asset's life costs—in other words, the cost is not retroactive.

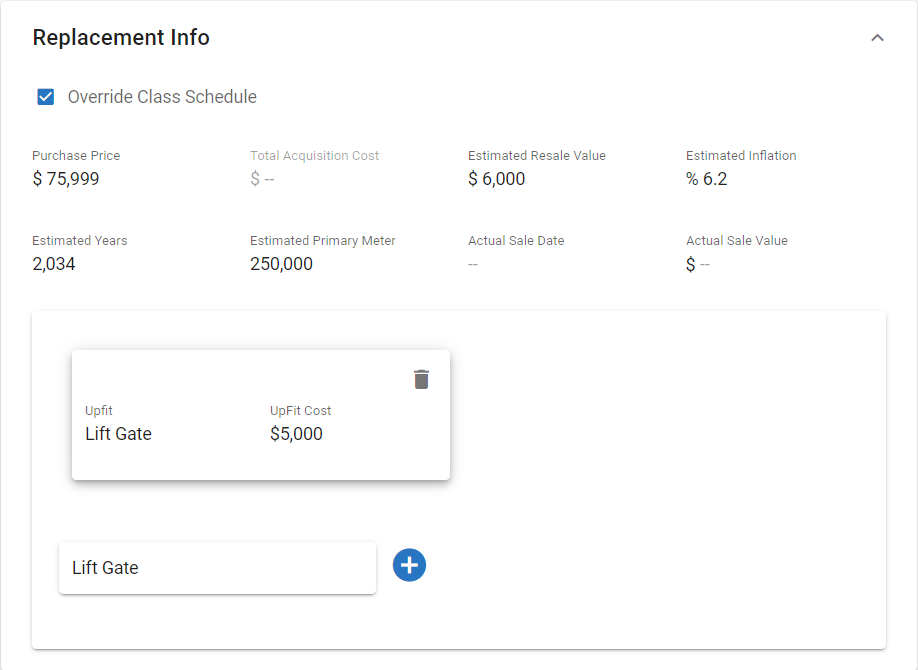

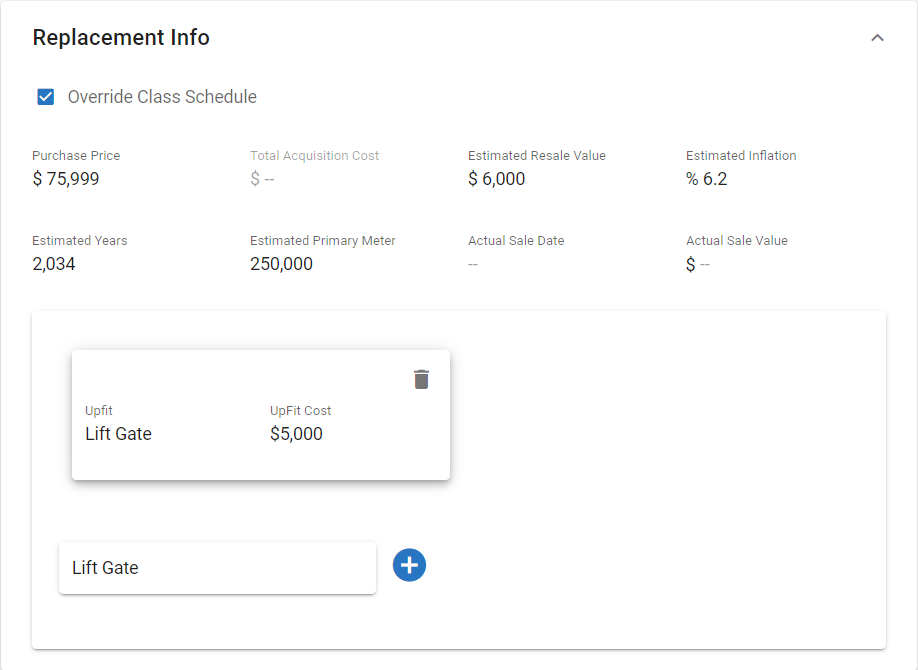

Replacement Info Panel

Click here to expand...

This panel is driven by data submitted in the asset class code replacement tab. See Class Code Replacement Tab here. There are many ways or methods to calculate when it is time for assets or equipment to be replaced. Including this type of information in the asset file will assist with projections and budgeting and assist with reporting on reliability of the asset.

Field Definitions in RTA Web

Purchase Price – Base purchase price for the asset

Total Acquisition Cost – Base purchase price plus upfitting's for the asset

Estimated Resale Value – Estimated resale or trade-in value of the asset

Estimated Inflation % – Estimated yearly cost of living increase in percent

Estimated Year – The year the asset will need to be replaced

Estimated Primary Meter – The number of units (miles/kilometers/hours) when the asset will need to be replaced

Actual Sale Date – Date the asset is sold

Actual Sale Value – Actual resale or trade-in value of the asset

Additional Options

Override Class Schedule – This selection de-couples the individual vehicle against the asset class

Add New Upfit – This adds additional upfitting cost to the asset for Spec items or added mounted equipment (i.e. Two Way Radios, Lift Gate, Light Bars)