RTA Web Assets - Financial Tab

The financial tab holds multiple panels all designed to hold pertinent information pertaining to asset financials. This article will cover all the panels and fields found in the financial tab.

You can visit Asset File Table of Contents to access the full list of articles related to Displayed Vehicle Data in RTA Web here.

🔓 Denotes fields that are editable within RTA Web by clicking in the field, entering the data, and clicking the check mark

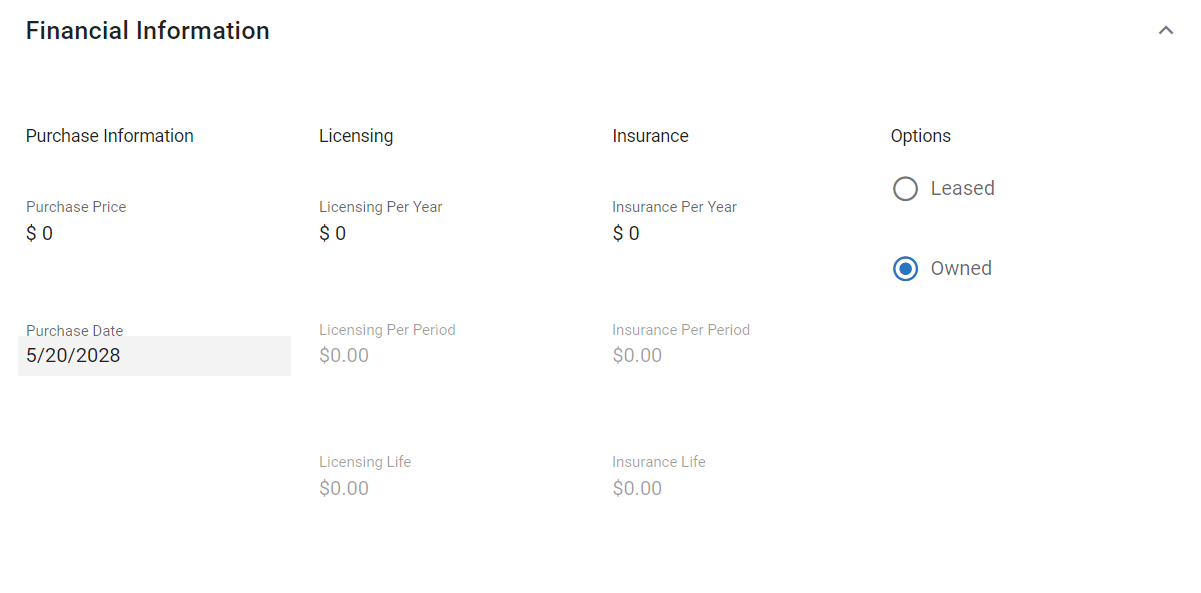

Financial Information Panel

The financial information panel is segmented into 4 categories: Purchase Information, Licensing, Insurance, and options. See below for descriptions of each field in this panel.

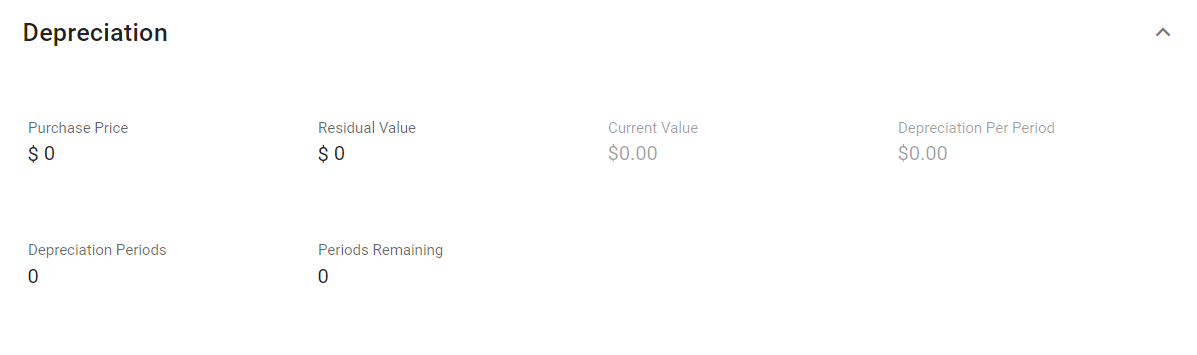

Depreciation Panel

The depreciation panel lists asset depreciation information. See below for descriptions of each field in this panel.

🔓 Purchase Price: Asset’s purchase price

🔓 Residual Value: Estimated trade-in value

🔓 Depreciation Periods: Total number of depreciation periods for the asset

🔓 Periods Remaining: Total number of depreciation periods remaining for the asset

Current Value: Auto-calculates based on depreciation data entered

Depreciation Per Period: Auto-calculates based on depreciation data entered

When entering depreciation for partially depreciated assets, the amount already depreciated does not post to the asset's life costs—in other words, the cost is not retroactive. To account for previously depreciated costs, an entry can be posted in the Audit File Adjustments option